Mispriced company to invest now: Goeasy stock analysis

Canadian small cap Goeasy is being offered at absurd prices.

Hi everyone.

In my first analysis I’d like to share a stock I am very excited about. We’ll talk about Goeasy (GSY.TO).

What Does Goeasy Does

Goeasy is a Canadian company that provides leasing and lending services to consumers in Canada and the States. It offers both secured and unsecured subprime short-term bonds.

Huh? Are you suggesting a company that offers subprime loans with all these fed hikes? I see why you would think that subprime loan’s morosity would increase even more than the morosity of prime loans during these times, but the reality is different. Let me explain.

Tom is a wealthy worker that leaves a wealthy lifestyle. Tom has an 120k office job, a mortgage, and a car lease. He is planning to marry and make a down-payment for a bigger house, but he can’t afford so with his current savings. He has a good credit score so he walks to a bank and asks for a yearly, unsecured loan, since he plans to repay all of it saving some money the following year. Suddenly the recession strikes. Tom loses his job. Tom ends with no income, two mortgages, a car lease and bank loan. Tom can’t afford to leave on the streets so with his 401k he manages to pay one mortgage and chooses not to repay the loan as planned. Tom’s credit score plummets. The bank’s morosity increases.

Jeese on the other hand is a janitor. Commutes to work in bus. Leaves with his parents. Jeese is missing some bucks to make the down-payment for an apartment. The bank would never offer him any kind of loan, so he walks to Goeasy and gets a high-interest subprime loan with less questioning. The recession strikes. Jeese has a modest lifestyle; no car, no unnecessary costs. He just needs to pay each monthly his mortgage and the interest of the Goeasy subprime loan. A janitor is still needed, even during recessions. His income barely decreases; he needs two extra months of work to be able to fully repay the loan but he still manages to do so within his range of time. The morosity of Goeasy does not increase.

A prime customer has twice as much debt as a subprime customer and a much difficult-to-maintain lifestyle.

I gathered this data and insights from a 2016 TransUnion study titled “Personal loan performance during times of stress” which examines subprime delinquencies over past crisis.

In the 2001 dotcom bubble, subprime delinquencies actually fell from 17.8% to 15.7% whereas other prime segments saw increases in delinquencies. Moreover, during the 2008 recession subprime delinquencies remain stable while other prime segments saw increases in delinquencies.

The stability has been attributed to a few reasons including lower levels of home ownership and debt.

A glance of the company

Goeasy had quite a prosperous history.

[All of the following figures shown are in millions of American dollars, except when specified]

Gooeasy’s operating income grows at a CAGR of almost 40% and its margins are really attractive. The company’s guidance is that they will be able to maintain operating margins above 35% in the years to come.

Goeasy business model is capital intensive. In simple terms, they need money to lend, to earn money. They have been financing their growth by selling more shares.

Although, the dilution of almost 5% annually seems irrelevant when you look to Goeasy’s ROE which is higher than 20%! In other words, Goeasy generates 15 cents for every dollar of equity they “borrow”.

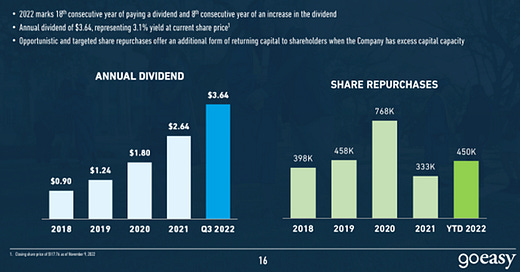

Oh. Here comes my favourite part: Goeasy returns the value generated to its shareholders.

[In canadian dollars]

Valuation

Goeasy is valued at 8 times earnings which is simply nonsense for a company that has been growing its EPS at a CAGR of more than 29% over the last 10 years.

I won’t give a price target (you can do that). I am confident that goeasy will do well over the long term if they continue operating as they are.

Company’s forecast

[In canadian dollars]

Potential risks

Regulation risks. Not likely but possible. Goeasy charges interests around 35% to clients. First they will regulate credit houses that charge interests of more than 60% so I don’t believe that the governments-to-come will be able to pass a bill that affects Goeasy anytime soon.

A comment from the writer

Wow… Finally finished my first post.

Please subscribe if this content was valuable to you. It’s completely free and by doing so you won’t miss out any of my future posts. All of them will be delivered weekly to your email inbox.

Pretty sure I suck at writing. Please , give me feedback. Was the analysis too long? Too short? I know I can’t explain everything because that will take an awful lot of time but also I like to support my views with data.

What do you think of Goeasy? Respond this email, I want to hear your views.

Oh, and in case you haven’t subscribed yet

See you next week.

You should post it on Jika.io

This does look good. I see these GoEasy stores all over the place now.