TransUnion (TRU) Stock Analysis and Valuation. Is It Worth It?

TransUnion is currently trading at 2018 price levels. But is it worth it?

What does TransUnion do?

Well if you are from America you probably already know this. TransUnion collects consumer data to create credit reports, analytics, and risk management services that help businesses assess consumer ability to pay for services and loans.

TransUnion operates in three segments:

-U.S. Markets

The U.S. Markets segment provides consumer reports, actionable insights, and analytics to businesses. These businesses use the services to acquire customers, assess consumer ability to pay for services, identify cross-selling opportunities, measure and manage debt portfolio risk, collect debt, verify consumer identities and mitigate fraud risk.

-International

The International segment provides services similar to the U.S. Markets segment to businesses in select regions outside the United States. Depending on the maturity of the credit economy in each country, services may include credit reports, analytics and technology solutions services and other value-added risk management services. They also have insurance, business and automotive databases in select geographies.

-Consumer Interactive.

The Consumer Interactive segment offers solutions that help consumers manage their personal finances and take precautions against identity theft. Services in this segment include credit reports and scores, credit monitoring, identity protection and resolution, and financial management for consumers. The segment also provides solutions that help businesses respond to data breach events.

All three segments grew consistently over time.

[In millions of American dollars]

TransUnion’s Competitive advantage

There is little room for another TransUnion since the barrier of entry is so high. Forget about the money, a new competitor would need a hell lot of data which TransUnion has been collecting for years. That’s why only three companies share the credit monitoring pie: Experian, Equifax and TransUnion. We will compare them later, to estimate a fair price for TransUnion.

A glance at the company

The company did really well in the past.

Although, observe that TransUnion is trading at 2018 levels. Is 2023’s TransUnion better than 2018’s TransUnion? Let’s find out

So TransUnion operating margins have shrunk over the last twelve months which might be the reason for the 50% price decline from the peak, along with the other harsh macroeconomic factors such as inflation and the expected recession.

But, why did the operating margins decline?

A combination of high debt and hikes of interest rates.

Foreign currency exchange headwinds.

Revenues declines of around 35% in the U.S mortgages sector due to mortgages inquiry downturn because of the high-interest rates.

Let’s analyze the debt situation.

Current ratio below 2x.

Net debt to EBITDA ratio is expected to be 3.6x by the end of fiscal year 2022. Although, it’s worth noting TransUnion always operates with such ratio above 3x.

Personally, I like highly leveraged, cash flow positive companies when their business model is so resilient and recurrent.

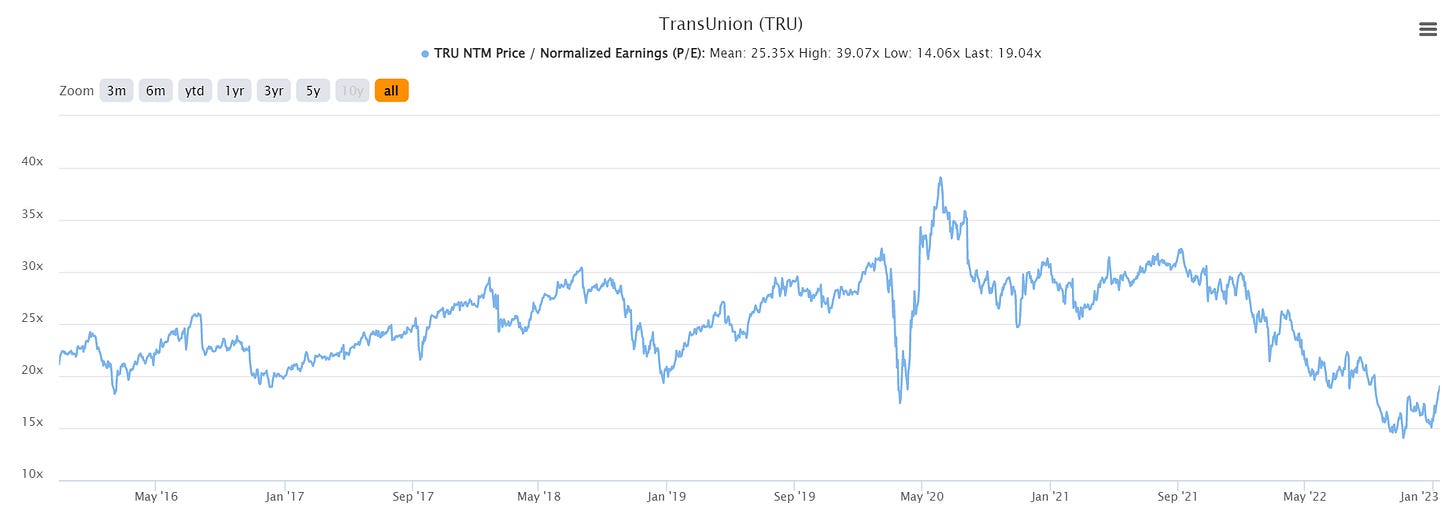

Observe how TransUnion's P/E ratio is near its all-time low since its IPO.

TransUnion grows organically and through acquisitions. It’s last year's acquisitions are the reason for TRU’s negative 2022 cash flow. With a cash flow margin above 15%, TransUnion was historically always able to repay its debts.

Market growth

Company’s forecast

In Q3 2022 they reafirmed their ability to achieve their 2025 financial targets.

Valuation

Over the last 5 years, they have been diluting their shares 1% per year but they have been repurchasing almost the same amount of the company shares every year so let’s assume no dilution. TransUnion dividend yeld is 0.6%

Experian and Equifax have a lower debt than TransUnion, therefore their higher P/E.

TransUnion, being a smaller company, still has room to expand worldwide. Its growth is expected to be more than that of Experian and Equifax.

For the matter of valuation, we’ll take a future P/E ratio of 25x, the current Experian ratio, and the historical mean of TransUnion ratio.

TransUnion expected adjusted diluted earnings per share (the metric that they use) is almost $4. They expect to grow that number by over $6 by 2025. This is a 50% increase.

Expected 2022 Normalized EPS is $3.7. We can estimate its 2025 Normalized EPS to be $5.6 after the 50% increase, according to the management guidance.

So let’s estimate conservatively TransUnion’s fair value in three scenarios.

Positive 2025 Scenario

Management accomplishes its guidance ($5.6), debt is reduced and the market starts pricing TransUnion at its historical average (25x).

$5.6 x 25x = $140

26% annualized return

Neutral 2025 Scenario

Fed maintains the rates high and the interests eat 10% of TransUnion’s earnings ($5). Business model and growth still remain solid so market prices TRU at 23x after being able to repay most of its debt.

$5 x 23x = $115

18% annualized return

Negative 2025 scenario

TransUnion grows but doesn’t quite accomplish to squeeze the synergies of its acquisitions. The mortgage market struggles more than expected. TransUnion can repay its debt but interest still hit earnings ($4.4).

The market is “bullish” on TransUnion’s future (20x) since TRU repaid most of its debt and the Mortgage market started recuperating with the fed’s low-interest rates. TransUnion should be on the road to those $5.6 EPS.

$4.4 x 20x = $88

8% annualized return

You might notice that my negative scenario expects an 8% annualized return. Interest rates cannot remain for two years at this level (that would land a disastrous deflation). The housing market might remain down for two years but still, without taking it into account, all of the other divisions of TransUnion should remain solid.

Personally, I’m not going to buy TransUnion. Not because it is a bad stock. I believe it will do great. But I already have better stocks in my portfolio, with higher expected returns and less risk.

For example, last week I analyzed Goeasy. Goeasy has more potential to grow its EPS, its price has been irrationally punished and it is not suffering any “mortgage crisis”. In case you missed it, check out Goeasy’s analysis.

As you know this is my second post. I took all your feedback into consideration while writing it. I believe this analysis to be far more complete than the first one but please tell me what you think. These analyses take an awful lot of time so I really appreciate any like, comment, or subscription you give for further difussion. It’s completely free.

I’m planning to reveal all of my portfolio during the following months, one stock at a time. So don’t miss out. See you all the next week.

Sources

Equifax, Experian and TransUnion data from TIKR Terminal

Thanks Alex, very good analysis very complete! You mention that you are going to present other companies in which you invest, is your portfolio specific to a sector? I would love to see your analysis of the company nvidia